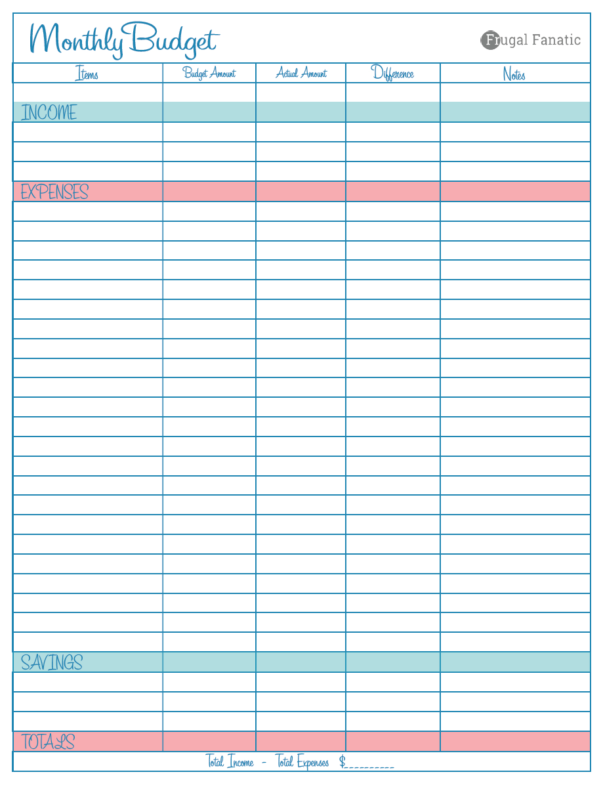

Savings SpreadsheetsĬreating a savings budget for your savings trackerīefore you can create a savings budget for your savings goal tracker, you need to analyze all the expenses you incur in the course of one month. Whatever design or style of tracker you plan to use, setting various increments to reach makes the document highly effective so that you know how much to set aside each time you receive your allowance or salary.

You can note this goal clearly with a house drawn on the middle of the page which you surround by bricks that you color one at a time until you reach your goal. You can also have a tracker for when you’re saving up for a new home.At the very top of the tracker page have a clever title like “Bringing Home the Bacon” where all the increments saved are strips of bacon which you color. For instance, you can have a tracker with a bacon theme and with a goal of setting aside money for home improvement. No need to get serious about your money goal tracker.Each flower petal represents a savings increment, which you would color each time you’re able to set aside enough money. You can also track your savings by drawing attractive flowers in a bullet journal.Then you can decide on how much to save for each month in order to reach your savings goal. Make a drawing of a huge jar which you would break every month. Place a money jar on your bullet journal.To add an element of fun, design your tracker as a coin holder with an old-fashioned design and some cute icons.You can divide your savings tracker into different areas for your savings.Every time you reach that specific amount, colored in one of the blocks on your savings goal tracker. You can have a savings tracker where your savings get broken down into specific increments.Here are some ideas about the different types of savings trackers: If you successfully reach your goals, create a new savings spreadsheet with even more ambitious goals. Make sure that you can reach all of the goals you set. How much do you intend to save? Do you plan to save monthly or weekly? You have to answer questions to determine your goals.

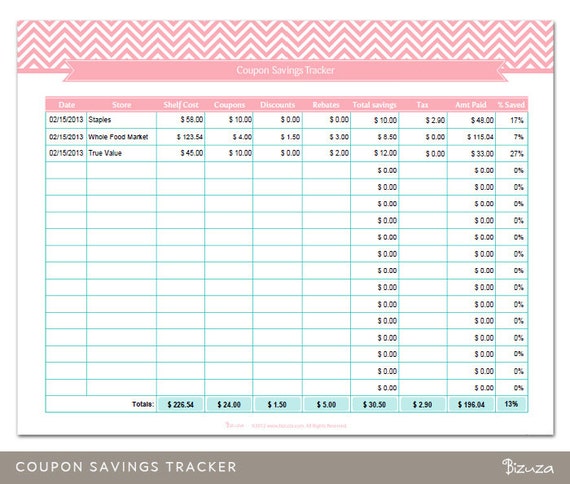

It can feel intimidating at the start but it’s quite easy, especially when you have set your goals for the tracker. Using a savings tracker or a money goal tracker helps you organize the way you save money. No matter how you choose to plan your savings, using a savings tracker or a savings goal tracker will help you monitor where you place all of your money. You can also “split” or “allocate” interest earned to different goals or accounts. You can see this when you make a deposit in your savings spreadsheet where a transaction, in this case, a savings deposit, gets split into multiple savings goals.

Most of us know about “deposits” and “withdrawals,” but what about “splits?” This is an allocation of a single transaction to several budget categories. If you do this, make sure to keep track of the amounts you’ve saved using your savings or money goal tracker. But still, money saved for other purposes are still all lumped up into one savings account. Many have their separate retirement savings too. Most people tend to put their medium-term and short-term savings into maybe one or two savings accounts. Most people usually have special savings accounts or just the normal bank accounts which have standard interest rates. This means that you place the money leaving your spending account in these specific separate “goals” or “savings accounts” as specified in your savings goal tracker. The first thing to keep in mind when you start managing your budget is to consider the money that you place into your savings as an “expense.” On your savings tracker, you need to have either a budget category for your savings or the main category with subcategories including “Emergency Funds,” “Travel,” “Education,” and more to name a few.

0 kommentar(er)

0 kommentar(er)